Photo Credit: Vlada Karpovich

INVESTMENT ENVIRONMENT1

Source: Orion Advisor Services, AlphaGlider

Both equity and fixed income markets performed well in the first quarter of 2023. This bullish result was in spite of continued rate hikes by US and European central banks and liquidity concerns emerging in the global banking system.

Bond market investors bought aggressively during the quarter, bidding up bond prices and in turn, driving down yields on those bonds. The Bloomberg US Aggregate Bond Index^e rose by 3.0%. Although bond investors are pricing in the Federal Reserve (Fed) raising rates another 25 basis points in May to 5.0-5.25%, they are expecting the Fed will be forced to cut rates by 75 basis points in the second half of this year—a recession scenario. For what it’s worth, Fed is predicting a “mild recession” later this year according to its March meeting notes, but doesn’t see the need to cut rates until 2024.

Equity investors ignored the bond traders’ recession narrative, and instead bought enthusiastically during the quarter. Foreign developed equities, as measured the MSCI EAFE,b led the way with an 8.5% increase in the quarter, while emerging markets (MSCI Emerging Markets)c lagged with a still respectable 4.0% increase. The US equity market (S&P 500)a was up 7.4%, driven mostly by its large technology companies.

Although this was the second sequential quarter of strong performance for both the equity and fixed income markets, they were still down over the last 12 months. Global equities (MSCI ACWI IMI)d were down 7.7% over this period, with US and emerging markets faring worse, while foreign developed markets doing somewhat less worse. The US bond market was down 4.8% over this period.

US Inflation continues to run hot and unemployment low, but both showed signs of moderating during the first quarter. Starting with inflation, prices were 5% higher than a year ago, and 5.6% higher when volatile energy and food prices are stripped out (i.e. core inflation)—similar to what we have seen since December and well above the Federal Reserve’s (Fed’s) stated goal of 2%.

Source: US Bureau of Labor Statistics

March’s unemployment rate came in at 3.5%, close to January’s 54-year low of 3.4% and little changed in over a year—as shown in the chart to the right. Adding to the Fed’s concerns that the tight labor market will make its fight to bring down inflation more difficult is that median weekly earnings of full-time wage and salary workers are now growing faster than inflation. Pay was 6.1% higher nominally in the first quarter of 2023 as shown on the chart below.

Source: Bloomberg

The moderating part of the US employment story comes from the US Bureau of Labor Statistics’s Job Opening and Labor Turnover Survey (JOLTS) which shows that there are now 1.67 job openings per unemployed person, down from a high of two job openings last year. JOLTS stood at 1.25 entering the pandemic and has averaged about 0.5 over past economic cycles. Bottom line from both inflation and jobs data is that the Fed has a lot more to do to slow an economy that it let run too hot with its overly accommodative policies.

Source: Charles Schwab

Against this backdrop, the Fed made two separate 25bps increases to its fed funds rate during the first quarter. As mentioned earlier, the markets have priced in another 25bps increase at its next meeting in early May, which would take its rate to 5-5.25%. This Fed rate hiking cycle has been considerably faster and larger than the previous six cycles going back to 1987 — as seen in the chart on the left. When the Fed changes the fundamental rules of the economy so substantially in such a short period of time, things are bound to break. Silicon Valley Bank (SVB) and Signature Bank, both large regional banks, were this hiking cycle’s early major victims.

The basic business model of a bank is to borrow short-term (i.e. take deposits from its customers), then turn around and lend those funds for a longer term at a higher interest rate (i.e. make car or home loans, or purchase bonds)—taking advantage of the usual term premium. There is a duration mismatch between the bank’s liabilities (i.e. its customers’ deposits) and the bank’s assets (i.e. the loans it makes and the bonds it purchases), but this is something that good managers of banks can manage.

The managers at SVB and Signature appear to have made several mistakes. On the asset side, they pushed too hard for yield, deploying too many of the deposits they collected to Treasuries with long durations. Although Treasuries are considered “safe” because they have never defaulted, like other bonds their value is sensitive to changes in interest rates, with longer duration bonds being more sensitive than shorter duration bonds—i.e. duration risk. After nearly 500bps of Fed funds rate increases in just over a year, the value of their long duration assets suffered mightily. However, losses alone aren’t usually enough to trigger a bank bankruptcy. There also needs to be a bank run—a rush of customers pulling out their deposits, forcing the bank to sell their assets, converting the bank’s unrealized losses into realized losses.

The more consequential mistake for SVB and Signature, however, was that they mainly solicited large and homogeneous companies for deposits—making a bank run more likely. SVB’s customers were mostly venture capital firms and tech startups, while Signature’s were mostly professional services, taxi medallions, and cryptocurrency companies. Being large customers, their deposits were well in excess of the Federal Deposit Insurance Corporation’s (FDIC’s) $250,000 insurance ceiling. This combination of size, sophistication, and interconnectedness gave their customers the urgent concern over the welfare of their deposits. Most of their deposits were not FDIC insured so if other customers pulled their deposits before they did, they may end up bearing the bank’s loss. The tight knit community of SVB and Signature clients quickly pulled their deposits and then went onto Twitter and Slack to warn their buddies to exit also.

The Fed and the Treasury quickly rushed in to stabilize the US banking sector, increasing the amounts they would loan banks so that they didn’t have to sell assets at a loss, and insuring 100% of deposits at SVB and Signature—all in an effort to reduce the likelihood for bank runs occurring at these and other banks. As I write this piece in mid-April, the Fed’s and Treasury’s efforts appear to have worked. Switzerland’s second largest bank, Credit Suisse, was forced into a pseudo-bankruptcy/acquisition in the week following the bankruptcy of SVB and Signature—but the spike in interest rates was merely the straw that broke the camel’s back. The real issue at Credit Suisse was nearly 15 years of mismanagement and perhaps corruption by its board and C-suite.

Although the global banking sector appears to be stable at the moment, it is far from healthy, especially at the smaller end. With large unrealized losses on their balance sheets, it is vital for them to retain their deposits to prevent converting them into realized losses which was the case for SVB and Signature. The Fed’s zero interest rate policy (ZIRP) allowed banks to get away with paying next to nothing on deposits since the 2007/8 Global Financial Crisis, but the Fed’s recent rate hikes has changed this. The banks currently find themselves between a rock and a hard place—they can either lower profitability by raising interest rates on its deposits, or they can lower profitability, and perhaps risk a bank run, by being forced to realize losses on their assets to pay back depositors leaving the bank to get higher yields. The chart above shows the difference between what most banks currently pay on deposits (0.2%) to what some niche banks are paying (5.0%). We may or may not see more bank runs, but we are seeing a lot of “bank walks” at the moment. Personally, I recently transferred the balance in the 35-year old savings account into Apple’s new high-yield savings account which pays 4.15%.

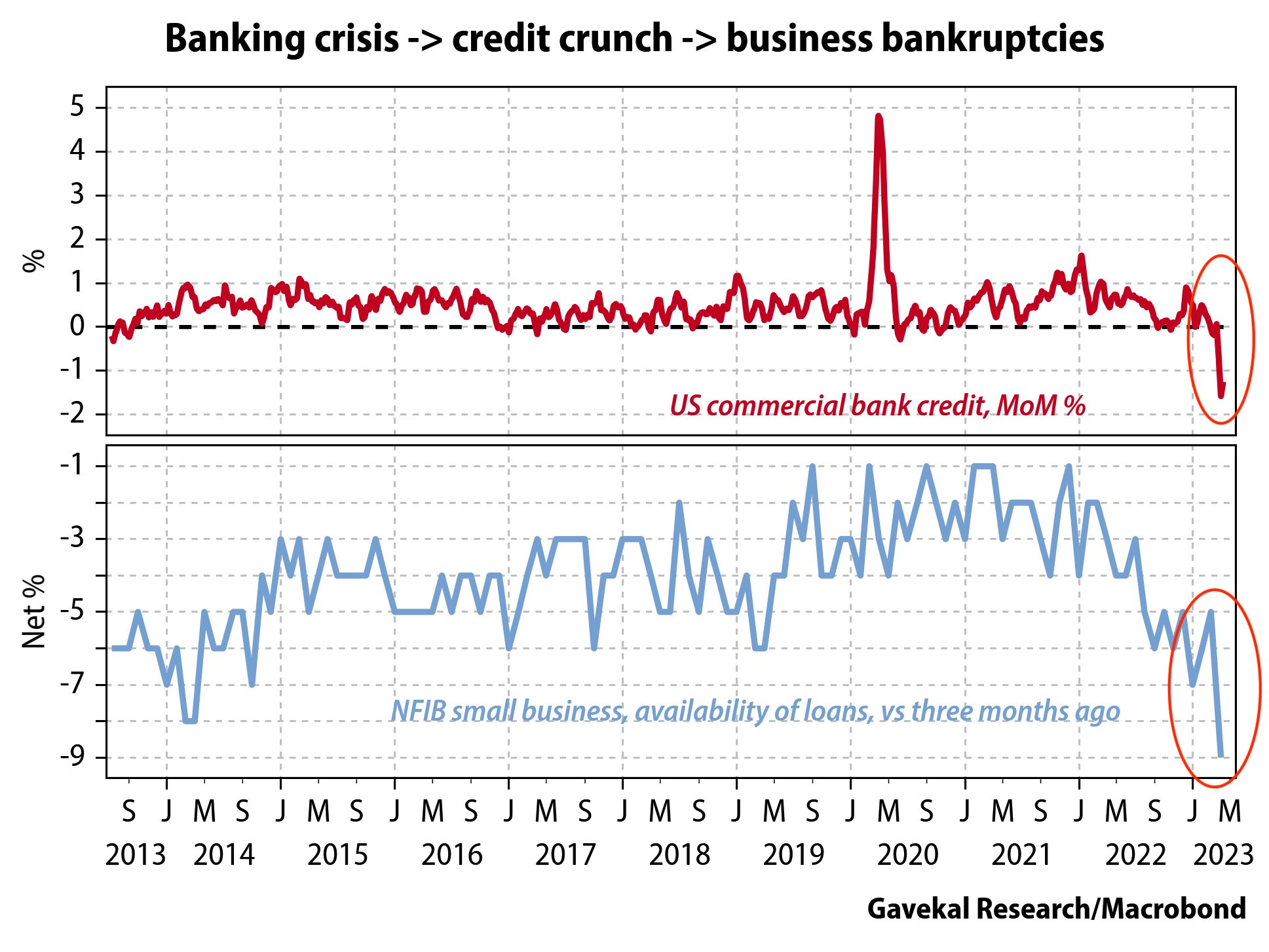

The banking sector’s recent troubles have serious implications for the broader economy. As deposits leave banks, where some of those funds had been productively plowed back into the economy via loans, they land in non- productive Treasuries and money market funds (many of which invest in Treasuries). Even if a consumer or small business can justify paying higher interest rates to finance a new investment (e.g. car, house, production line), banks may not be willing to offer up that loan. The chart above shows that this has already started. Higher rates and reduced credit are working to apply the breaks on the economy, and in turn, corporate profits.

The last topic to cover on the domestic front is the looming federal debt ceiling deadline. Sometime this summer the US government debt is expected to reach the $31.4 trillion debt ceiling. For the US government to avoid default on its debt, Congress must raise this debt ceiling, a process that is usually uneventful and non-political given the grave implications of it occurring. This year, however, is different. House Republicans, who have a controlling majority, are demanding spending be cut to last year’s levels, capping growth at 1% per year thereafter, and reversing some of President Biden’s policy goals before they will go along with raising the debt ceiling. We will be monitoring developments in this area closely over the coming months as a US government debt default would have catastrophic impacts on US and international investment markets.

Moving overseas, OPEC+ unexpectedly announced in early April that it would cut oil production by 1.16 million barrels per day by May. This caused oil prices to immediately rise $5/barrel to approximately $80/barrel, a level at which it has held in recent weeks. Oil was trading around $100/ barrel this time last year.

While the front lines in Ukraine remained relatively static during the first quarter, Ukraine is expected to launch a counter offensive in the spring. Perhaps of more consequence to the global economy at the moment are rising tensions between China and the US. In February, the US shot down a Chinese spy balloon off the South Carolina coast. And earlier this month, China conducted military exercises around Taiwan after Taiwan’s President Tsai Ing-wen made a private visit to New York and California which included meeting with US House Speaker Kevin McCarthy.

PERFORMANCE DISCUSSION

First Quarter

During the risk-on environment of the first quarter, our conservatively positioned AlphaGlider strategies matched only 80-85% of the strong performance of their respective benchmarks.

AlphaGlider strategies were held back by two factors, both of which helped them outperform in 2022. First was their conservative positioning in the US market. In a quarter during which large cap technology companies excelled, our skew towards value, high quality, and small cap companies held back our strategies. Second was the short duration of our bond holdings which underperformed as forward interest rates declined.

There were also a couple of factors that hurt us in 2022 and continued to do so in the first quarter. First was our overweight position in emerging market equities. The second was our stake in international real estate investment trusts (REITs).

The following are individual funds2 that particularly helped, and hurt, our strategies’ performance during the quarter relative to our equity and bond index benchmarks (MSCI ACWI IMI +7.0% & Bloomberg US Aggregate Bond +3.0%):

Significant Relative Detractors in 1Q23:

1.9% Vanguard Global Ex-US Real Estate, VNQI

-1.3% Vanguard Market Neutral, VMNFX

-0.4% iShares Global Clean Energy, ICLN

+1.0% Vanguard Value, VTV

+1.6% iShares ESG 1-5 Yr Corporate Bond, SUSB

+1.7% Vanguard Short-Term Treasury, VGSH

+1.8% Vanguard Short-Term Corporate Bond, VCSH

+1.9% Vanguard Dividend Appreciation, VIG

+3.7% Vanguard Emerging Markets, VWO

+3.7% Vanguard Small-Cap, VB

+4.7% iShares ESG Aware MSCI EM, ESGE

Significant Relative Benefactors in 1Q23:

+20.8% Fidelity MSCI Information Tech, FTEC

+9.3% iShares ESG Aware MSCI EAFE, ESGD

+9.2% Vanguard ESG US Stock, ESGV

+8.2% SPDR Portfolio Developed World ex-US, SPDW

Last 12 Months

All AlphaGlider strategies beat their respective benchmarks during the last 12 months. Much of this outperformance came from our conservative positioning, particularly within our bond allocations which were short in duration and heavy in safer government bonds relative to our fixed income benchmark, the Bloomberg US Aggregate Index. We were also helped by the conservative footing within our US equity exposure where we were underweight and what exposure we did have was skewed to value and quality companies.

Despite the war in Ukraine, our large foreign developed equity positions, especially those in Europe, performed well on a relative basis. Our position in physical gold, which we exited in March, also helped performance.

On the negative side of the ledger, our AlphaGlider strategies were hurt by their overweight positions in emerging market equities and international REITs. AlphaGlider’s ESG strategies were hurt by their avoidance of the energy sector.

The following are individual funds that particularly helped, and hurt, our strategies’ performance during the last 12 months (LTM) relative to our equity and bond index benchmarks (MSCI ACWI IMI -7.7% & Bloomberg US Aggregate Bond -4.8%):

Significant Relative Benefactors over LTM:

+7.3% Vanguard Market Neutral, VMNFX

+1.7% SPDR Gold MiniShares, GLDM

-0.1% iShares ESG Aware MSCI EAFE, ESGD

-0.2% Vanguard Short-Term Corporate Bond, VCSH

-0.3% Vanguard ST Inflation-Protected Securities, VTIP

-0.4% iShares ESG 1-5 Yr Corporate Bond, SUSB

-2.3% iShares MSCI Singapore Capped, EWS

-3.0% Vanguard Dividend Appreciation, VIG

-3.3% SPDR Portfolio Developed World ex-US, SPDW

-4.0% Vanguard Value, VTV

Significant Relative Detractors over LTM:

-21.5% Vanguard Global ex-US Real Estate, VNQI

-12.1% iShares ESG Aware MSCI EM, ESGE

-10.3% Vanguard ESG US Stock, ESGV

OUTLOOK & STRATEGY POSITIONING

If 2022 were a road, it would have been a curvy one, with the occasional monster pothole. Stubbornly high inflation, rapidly rising interest rates, Covid-zero policies, and a war in Europe can ruin any Sunday drive. In an unusual fashion, both stocks and bonds fell by double digit percentages. A traditional US-based 60/40 portfolio (60% S&P 500, 40% Bloomberg US Aggregate Bond) declined 16.1%, its third worst year in history, exceeded by only two years during the Great Depression.

When you find yourself sitting in the back seat on one of these curvy, bumpy drives, it is important not to have your head down in a book or your phone, right? Instead, you need to take some deep breaths and look out the window at the horizon. Look at a distant object. Same goes for how to ride out rough investment markets like we experienced in 2022, and as we’ll inevitably have to do so again over the coming decades.

The distant object on the horizon that we need to focus on is the long-term expected return of our investment portfolio. As I laid out in my Long Time Horizons blog post way back in 2015, we have valuation metrics that give us a good idea what that will be. These metrics are reliable at identifying the range of values for our investments in the distant future, but do little to predict the route we’ll take to get to them. One thing that we know for sure is that it won’t be a smooth, straight road, but one unpredictably switching between calm stretches and unpleasantly violent curves.

At the beginning of 2022, our valuation metrics warned us that our long-term returns would be modest. This was backed up by the forecasting model in AlphaGlider Planning, which projected our balanced strategy (AG-B) to return a modest 4.1% annualized nominal rate (i.e. before inflation) over the coming 10-15 year period. With the market pricing in 2.6% average annual inflation over the coming decade, AG-B was only forecast to grow 1.6% on an annual real (i.e. after-inflation) basis. A hypothetical $100,000 AG-B portfolio entering 2022 was only expected to hit $148,800 exiting 2031, or $116,000 in real terms.

At the end of the bad ride that was 2022, investors were left licking their wounds, including our own. Based on a composite of our clients’ AG-B portfolios, the $100,000 AG-B portfolio would have declined 12.9% to $87,110—better than the 16.0% decline in our benchmark, but still painful nonetheless. However, that distant object on the horizon, the long-term expected values for our portfolios, hadn’t moved all that much. In fact, they had actually improved somewhat. For those focused on the horizon, car sickness avoided!

AlphaGlider Planning uses JP Morgan (JPM) Asset Management’s projections for long-term expected returns of the universe of available investment assets. JPM updates its projections at the beginning of each year, and below I show the massive step-up in projections for important asset categories that JPM made between 2022 and 2023. As JPM notes in the prologue of its 2023 Capital Market Assumptions report, “our assumptions [are] very different from last year’s. Our return forecasts move significantly higher across many asset classes. Lower valuations, higher yields and the accompanying unwind of many policy dislocations mean that markets today offer the best long-term return potential in more than a decade.”

Source: AlphaGlider, JP Morgan Asset Mgmt

At the beginning of 2023, AG-B’s long-term expected annualized returns jumped to 7.0% nominally, and 4.7% on a real basis. The nearly tripling of the real expected return of AG-B is mostly due to higher expected nominal asset returns, but also a result of a more aggressive positioning in AG-B and a slight decline in the market’s expectation for long-term inflation rates.

So let’s go back to our hypothetical AG-B portfolio, which started 2022 at $100,000 but fell 12.9% to $87,110. Using AlphaGlider Planning’s 7.0% nominal, 4.7% real, long-term return exceptions from 2023, would would expect the hypothetical AG-B portfolio to now exit 2031 at $159,900* (vs $148,800 expected going into 2022), or $123,000 in real 2022 dollar terms (vs $116,000 expected going into 2022). So despite the horrible road that was 2022, we are now expecting AG-B, as well as our other strategies, to end up in a somewhat better place in the long-term than we had expected entering 2022.

*one major disclaimer with these AlphaGlider Planning/JPM return expectations—they are average expectations and have standard deviations attached to them. For example, the 7.0% nominal annualized expected return for AG-B at the beginning of 2023 has a 10% annual standard deviation associated with it. Doing a bit of statistics and making some over-simplifying assumptions that probably don’t hold, we should expect there to be a 68% probability that the nominal value of our hypothetical AG-B portfolio to exit 2031 within the range of $133,800 to $186,100.

We think that JPM’s projections are reasonable and serve as a solid and consistent basis for AlphaGlider Planning financial modeling purposes. However, all projections are highly subjective and will thus differ. We share JPM’s preference for international stocks over their domestic counterparts (see previous chart), but we actually think that the gap in long-term expected returns between the two asset classes may be even larger than JPM forecasts of approximately 2% per year. Our thinking is more inline with the likes of GMO and Research Affiliates (RA) which see developed markets outperforming US markets by 3-5%, and emerging markets by 6-7%, annually. However, the total expected returns for AlphaGlider strategies would not change much in AlphaGlider Planning if we were to use GMO or RA projections.

For my clients who haven’t yet addes their financial details into AlphaGlider Planning, I highly recommend that you do so. I find that it is a great tool to help one focus on the distant object on the horizon, especially during periods of market stress and volatility.

We made a few changes to AlphaGlider strategies during the first quarter, most notably the exit of our physical gold positions. We bought gold two and a half years ago when short term rates and inflation were extremely low, money supply was exploding, and the Fed had just announced its new “average inflation targeting” policy. In combination, these factors got us worried that the Fed may let inflation run too hot. We found gold an attractive asset that has held its own in times of rising inflation and currency debasement, while not sacrificing much in terms of yield—its lack of dividends/interest wasn’t much less than the miserable yield of the short-term Treasuries we sold to buy the gold.

As we all know, the inflation we worried about did appear in a big way. Unfortunately gold didn’t respond as well as we had hoped, declining a few percent. With the Fed pushing its overnight rate towards 5%, we decided in March to move back into ultra-short term Treasuries. Naturally, gold popped 10% in the weeks after we sold it, driven by fears over the stability of the global banking system when SVB and Signature went into receivership. Sometimes you’re lucky, sometimes you’re not.

We also modestly increased the position sizes of our market neutral mutual fund throughout our strategies. This fund is generally long value and short growth, and thus should be resilient should the economy roll over into recession. This fund performed well in 2022, providing much needed ballast for our strategies.

1% FOR THE PLANET

With 2022 in the books, AlphaGlider is pleased to announce that it made its 2022 1% for the Planet donation to the Honnold Foundation. Founded in 2012 by the renowned rock climber Alex Honnold, the Honnold Foundation works to provide access to solar energy in disadvantaged communities around the world. This is our fifth year supporting organizations which contribute to addressing the challenge of climate change.

THE BIG 1-0

Finally, I am delighted to announce that AlphaGlider celebrated its 10 year anniversary last month. It has been an incredible journey, and we owe our success to your trust and support. Your referrals have been especially invaluable as they are by far our main source of growth.

As we celebrate this milestone, we reflect on what we have built, the challenges we have overcome, and the relationships we've built. We are excited for what the future holds and look forward to continuing to serve you with excellence.

Thank you again for your trust, referrals, and partnership. Here’s to many more years of success!

**NOTES & DISCLOSURES**

1This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

2Mutual funds, exchange-traded funds and exchange-traded notes are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

3Alternative investments, including hedge funds, commodities and managed futures involve a high degree of risk, often engage in leveraging and other speculative investments practices that may increase risk of investment loss, can be highly illiquid, are not required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are subject to the same regulatory requirements as mutual funds, often charge higher fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager. The performance of alternative investments including hedge funds and managed futures can be volatile. Often, hedge funds or managed futures account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, including hedge funds and managed futures and none is expected to develop. There may be restrictions on transferring interests in any alternative investment. Alternative investment products including hedge funds and managed futures often execute a substantial portion of their trades on non-US exchanges. Investing in foreign markets may entail risks that differ from those associated with investments in the US markets. Additionally, alternative investments including hedge funds and managed futures often entail commodity trading which can involve substantial risk of loss.

4Rebalancing can entail transaction costs and tax consequences that should be considered when determining a rebalancing strategy.

^Indices are unmanaged and investors cannot invest directly in an index. The performance of indices do not account for any fees, commissions or other expenses that would be incurred.

aThe Standard & Poor's 500 (S&P 500) Index is a free float-adjusted market capitalization weighted index that is designed to measure large cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization in the US equity markets.

bMSCI Europe, Australasia and Far East (EAFE) Index is a free float-adjusted market capitalization weighted index that is designed to measure the investable universe of developed market equities outside of the US.

cMSCI Emerging Markets (EM) Index is a free float-adjusted market capitalization weighted index that is designed to measure large and mid-cap equity market performance in the global Emerging Markets.

dMSCI All-Country World (ACWI) Investable Market Index (IMI) is a free float-adjusted market capitalization weighted index that is designed to measure the investable universe of global equity markets.

eThe Bloomberg Barclays US Aggregate Bond Index is a market capitalization weighted index that is designed to track most investment grade bonds traded in the United States. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds and a small amount of foreign bonds traded in the United States. Municipal bonds and Treasury Inflation-Protected Securities (TIPS) are excluded due to tax treatment issues.

Copyright © 2023 AlphaGlider LLC. All Rights Reserved.

No part of this report may be reproduced in any manner without the express written permission of AlphaGlider LLC.