Source: Orion Advisor Services, AlphaGlider

The second quarter of 2024 was somewhat mixed for major asset investment classes. Global equities markets (MSCI ACWI IMI)^d turned in a solid 2.4% gain while US bonds (Bloomberg US Aggregate Index)e disappointed with a flat showing. Emerging markets (MSCI EM)c had the strongest performance among equity regions, up 5%, closely followed by the US market (S&P 500),a up 4.2%. Developed foreign markets fell -0.4% during the quarter.

Global equities performed extremely well over the last 12 months, driven by the roaring US market that was up 24%. Both developed and emerging market equities returned about half this amount, 12%. US bonds increased a lackluster 2.6%.

Source: CNBC

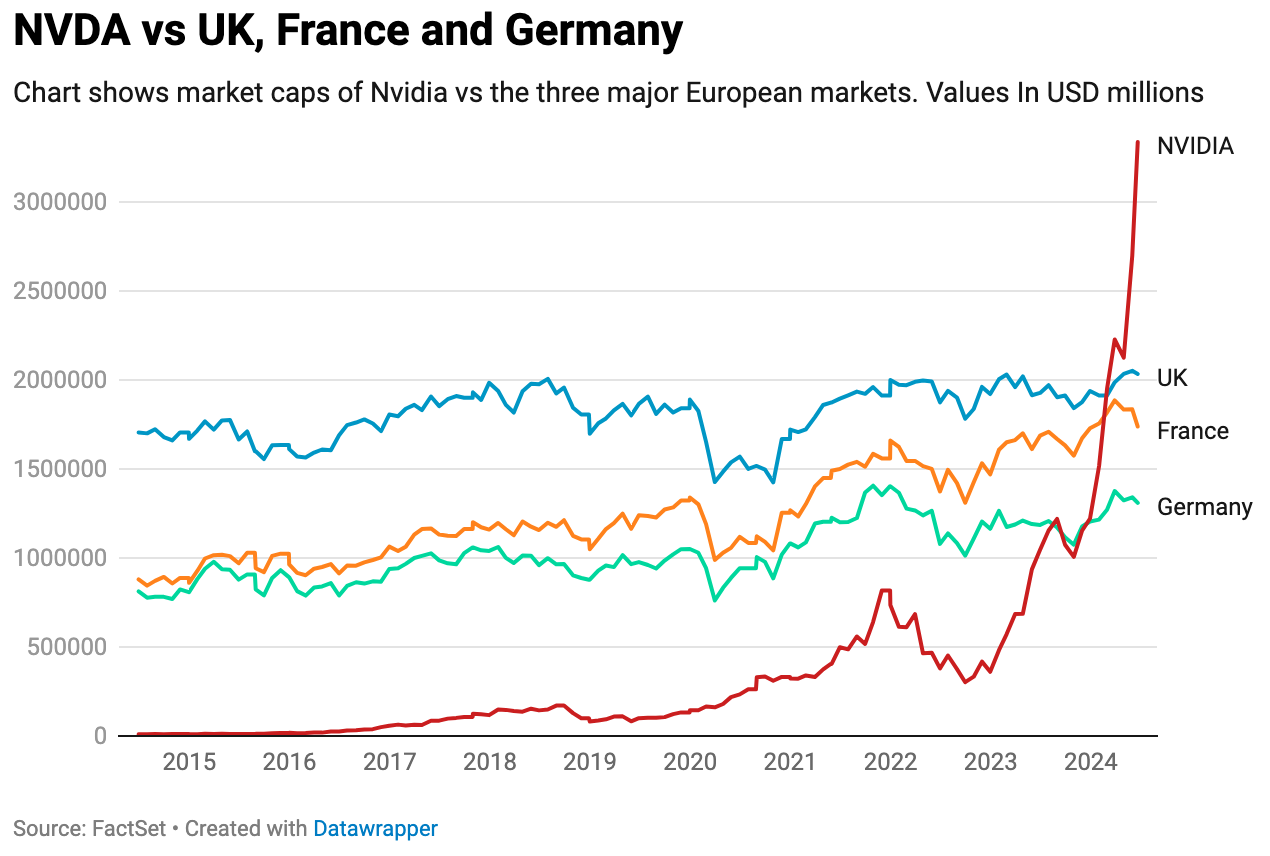

The “Magnificent 7” stocks (Apple, Nvidia, Microsoft, Meta, Alphabet, Amazon, Tesla) continue to be the main upwards driver of the US stock market. These seven companies drove 61% of the S&P 500’s gain during the first half of this year, on top of the 63% last year. Some fun facts about the darling of this group, Nvidia (ticker NVDA), the leading maker of generative artificial intelligence (AI) processors: Nvidia now makes up approximately 6% of the total US market capitalization. Its market cap per employee nearly broke $100 million in the middle of June. It now trades on 24x its next 12 months of sales, versus 2.9x for the entirety of the S&P 500 and 1.9x for all foreign stocks. As the chart to the left shows, its value blew past each of the three largest European stock markets, UK, France, and Germany. Only India, Japan, China and the U.S. have stock markets bigger than Nvidia alone.

The US economy remained on its soft landing glide path during the second quarter. Consumer spending remained strong, but slower than before. Unemployment ticked up slightly to a still low 4.1%, the result of an increase in labor supply rather than falling demand for workers.

Against this backdrop, inflationary pressures continue to ease. The June core consumer price index (CPI) clocked in 3.3% higher than a year ago. Over the past three months, core CPI rose at an annualized rate of 2.1% — a large pullback from May and the lowest since the onset of the inflation shock. The markets are looking for at least two rate cuts in the four Federal Reserve (Fed) meetings left in 2024, with the first cut coming in September.

The Congressional Budget Office (CBO), the official agency tasked to provide objective, nonpartisan information to support the federal budget process, updated its deficit forecasts last month. It revised up its FY24 deficit forecast to $1.9 trillion, a strikingly large 6.7% of gross domestic product (GDP). It also increased its estimates for the next 10 years. The CBO now expects deficits over the next decade to add an additional $22.1 trillion to today’s nearly $27 trillion of federal debt currently owed to the public. This estimate assumes the expiring provisions from 2017’s Trump Tax Cuts and Job Act (TCJA) are not renewed. If Trump were to win reelection, chances are high that most of these provisions would be renewed, especially if his fellow Republicans were to take control of the Senate and retain the House. If this were to happen, another $5 trillion of debt would be rung up over the next decade — pushing US federal debt to $54 trillion dollars exiting 2034.

Source: Alphaglider, J.P. Morgan Asset Management; data from CBO

As the bottom of the two charts on the right shows, US debt exploded from less than 40% of GDP before the 2007/8 global financial crisis (GFC) to nearly 100% today. The three largest drivers of this rapid increase were economic stimulus spending to revive the US economy during the GFC, the passage of the TCJA in 2017, and then more stimulus during the Covid pandemic.

This spending did its intended purpose for the economy, and in turn helped boost US corporate profitability and share prices. The cost of this additional debt was initially minimal given the rock bottom interest rates during the 2010s. However, this has all changed with the rise of inflation and in turn, interest rates over the last two years. The chart below shows the annual interest incurred by US debt more than doubled over the last three years to approximately $1.15 trillion — now more than what the US spends individually on Medicaid, Medicare, and defense.

The CBO warned that the rising share of interest payments within the government’s budget will increasingly crowd out discretionary spending on important government priorities, such as defense spending. For example, the CBO said that by 2041, payments on interest will be twice as large as defense spending, thanks in part to the fact that the rising cost of the debt will squeeze defense spending down from 3% of GDP this year to a projected 2.3% — an unpalatable scenario in light of China’s rapid military buildup and an ongoing war on the European continent. We are concerned that the tailwinds provided by large US deficit spending over the last 16 years for the US economy will flip into headwinds in the future — headwinds such as higher individual and/or corporate taxes, reduced government spending on high priority areas, and higher interest rates to attract larger debt issuances to cover deficit spending — all things that would be detrimental to economic growth. Neither Democrats nor Republicans seem to be concerned about government debt and deficits during this US election cycle.

Moving overseas, Conservative rule ended in the UK after 14 years. The choice to leave the European Union (EU), first decided in a referendum in 2016 and pushed through by Tory Prime Minister Boris Johnson in 2019, has had detrimental effects to trade, employment, and the cost of living. One independent analysis estimated that the UK’s real GDP is about 2 to 3% lower today than it would have been if it had stayed in the EU. With the decision to leave the EU now unpopular in the UK, we anticipate that the incoming Labour government will try to reestablish better economic ties with the EU going forward which should be positive for business on both sides of the English Channel.

A potentially more consequential election unexpectedly occurred across the Channel in France. After a strong showing by the far right in France’s elections to the EU in early June, the centrist President Emmanuel Macron called a snap parliamentary election that spanned between late June and early July. After the far right performed well in the preliminary round of voting, the centrist and far left parties teamed up to prevent their candidates splitting the vote and allowing far right candidates to win. The strategy worked, giving the far left party candidates the largest, but not a majority, control over Parliament. The lack of a clear majority opens a period of uncertainty over France’s political direction, but an outcome that most investors preferred over the possibility of far right economic and political policies that could have threatened France’s participation in the EU and the North Atlantic Treaty Organization (NATO). Macron remains President but faces a challenge getting the far left and the centrists on the same page.

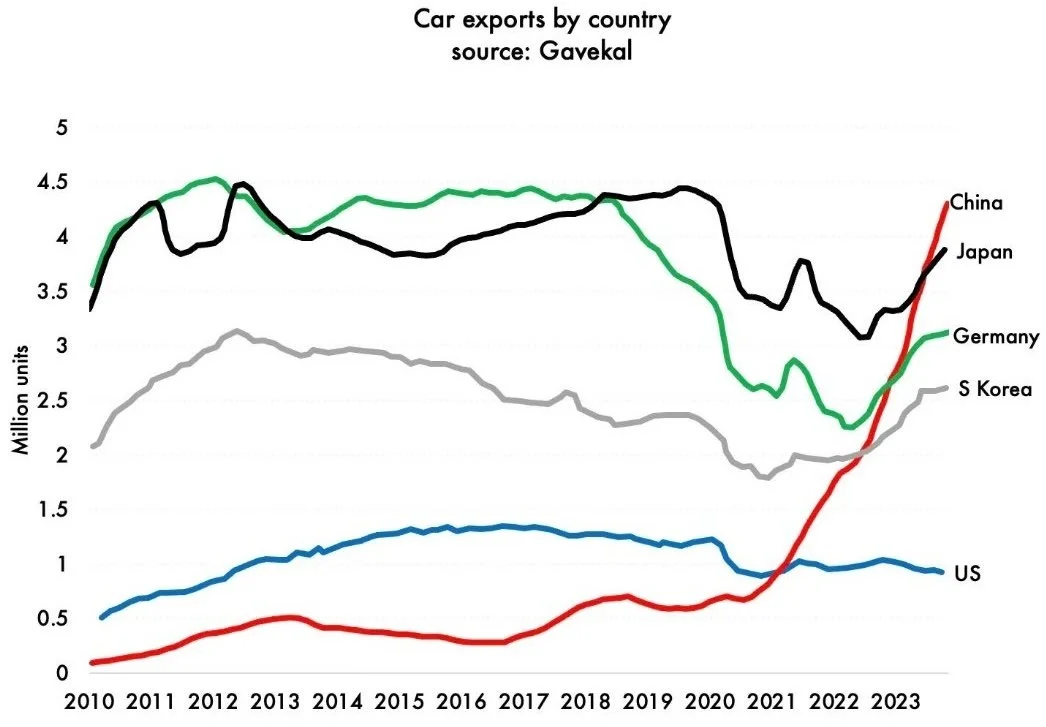

Regardless of election outcomes in the West, the economic and military rivalry between the West and China continues to heighten. Back in 2018 and 2019, the Trump administration applied tariffs on approximately $380 billion of Chinese imports, tariffs the Biden administration mostly retained. In May, the Biden administration announced additional tariff hikes on $18 billion of Chinese imports, including a 100% tariff on Chinese electric vehicles that effectively locks them out of the US market. The EU quickly followed the US’s lead by imposing new tariffs of up to 37.6% on Chinese EVs, this on top of its standard 10% duty on all imported automobiles. Canada is expected to increase its tariffs on Chinese EVs in the near future. Chinese EVs dominate markets where they do not face penalizing tariffs. For example, over 80% of EVs sold in Australia this year have been Chinese. On the back of its cost competitiveness in EVs, China is now the largest auto exporter in the world as shown in the following chart.

Former President Trump has promised to apply 60% tariffs on all Chinese imports if he is reelected. Perhaps even more concerning for the US and global economies, Trump has floated an across-the-board 10% tariff on all imported goods, including those from Western allies of the US. According to the Tax Foundation, this tariff would amount to a $300 billion annual tax hike on American consumers. The tariffs would reduce the size of the US economy by 0.7% and eliminate over 500,000 jobs — and that’s before considering the ill effects of retaliation from its trading partners.

PERFORMANCE DISCUSSION

Second Quarter

AlphaGlider strategies lagged their respective benchmarks by 0.5% to 1.0% percentage points during the second quarter. The primary driver of this underperformance was our strategies’ large underweighting of US equities and overweighting of developed foreign equities. To a lessor extent, we were hurt on a relative basis by the skew of our US equity exposure to small caps, quality, and value, and away from the largest US technology companies that continued to perform well on the back of the generative AI boom. Our more aggressive ESG portfolios were held back by their exposure to the clean energy sector.

On the positive side, our strategies benefited from their overweighting in emerging market and Singaporean equities. We were again helped by our fixed income sleeves of our strategies, mainly due to their positioning toward shorter duration bonds. And although clean energy equities hurt some of our ESG strategies, avoiding poorly performing fossil fuel equities benefitted all of them.

Last 12 Months

During a strong 12 month period for diversified investors, our strategies matched about 80% of their respective benchmarks’ returns. As with the second quarter, our underweighting of the US equity market, particularly of its largest technology companies, dented our relative performance. The relative poor performance from international equity markets, particularly China, also hurt our strategies. Our ESG strategies were also held back over the last year by their exposure to clean energy companies and underexposure to fossil fuel companies.

All AlphaGlider strategies benefited from their fixed income investments’ short duration and exposure to emerging market bonds. They were also helped by their healthy positions in a market neutral equity fund.2

LOOKING FORWARD

While AlphaGlider strategy returns have been solid in absolute terms over the last five years, they have modestly lagged their indexed benchmarks. Some of the drags on performance are always unavoidable, such as advisory fees, fund management fees, required cash balances, and trading at the AlphaGlider and fund level due to the bid-ask spread, but some of our underperformance was due to our asset selection. As valuation sensitive, long-term, and often contrarian investors, we missed out on some of the recent strong performance exhibited by large cap US technology companies, particularly those exposed to the field of generative AI. We have favored international equity markets over that of the US, and within our underweight US equity investments we prioritized value, quality, and smaller companies. In this section I will reexamine the logic behind this positioning and why we still still think it is valid in light of today’s valuations.

Source: J.P. Morgan Asset Management

Equities: US vs International

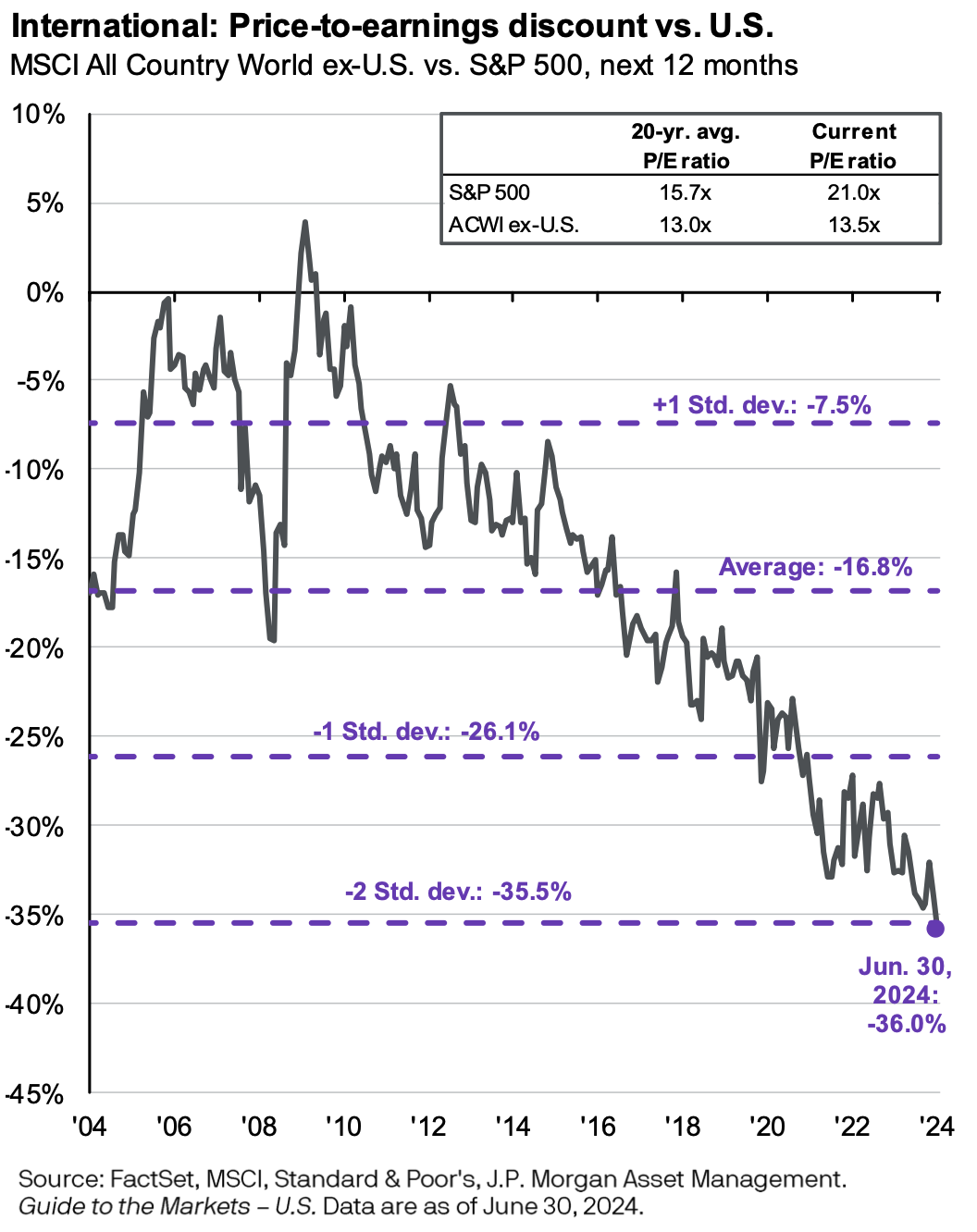

The S&P 500 has experienced a spectacular 558% total return (i.e. including reinvested dividends) between its trough in March 2009 and the end of the second quarter 2024. This blows away the 255% and 197% put up by developed ex-US and emerging markets, respectively, as measured by Vanguard’s VEA and VWO exchange-traded funds. While much of this US outperformance was well deserved, some of it may not. Broadly speaking, US companies grew their profits and cash flows faster than their international peers with help from the growth of the highly profitable US tech sector, but also by less sustainable drivers such as a large increase deficit spending by the US government, reduced corporate tax rates, and stimulative Fed policies. An additional driver of S&P 500 outperformance was the large expansion in its earnings multiples. The chart to the above right shows the valuation discount for foreign companies relative to US companies. Investors went from paying a similar multiple of earnings coming out of the global financial crisis, to paying a 36% premium exiting Q2. For those of you who are statistically inclined, we are currently experiencing at two standard deviation event. For those of you less so, this means that this premium for US companies has only hit this level or higher five percent of the time; 95% of the time, this premium has been lower. Investors are now paying $21 for every dollar of S&P 500 earnings over the coming year (i.e. 21x PE), versus only $13.50 for a dollar of foreign firm earnings (13.5x PE).

But earnings of the near-term can be volatile so valuation metrics based upon them can be unreliable and misleading in estimating future long-term investment returns. That is where cyclically adjusted earnings, and the CAPE ratio (aka PE10 or Shiller PE) of the market price to those earnings come to our aid. By taking the average of inflation-adjusted earnings over the last 10-years and comparing it to the price, CAPE ratios have proven to be one of the more reliable predictors of future long-term (e.g. 10-15 years) returns. The S&P 500 is currently trading at a CAPE ratio of 35x, consistent with rather poor, low single-digit future nominal (including inflation) annual returns. On the other hand, foreign developed and emerging markets trade at a CAPE of 19.1x and 15.7x, respectively, predicted mid to high single-digit returns.

Any way you slice it, the market has high expectations of profit and cash flow growth from the S&P 500. Growth will have to be near perfect over the coming decade to generate anything near its 10%+ historical annual returns. Expectations are much more modest for foreign companies and similar to their 20-year average, allowing for even moderate growth to convert into solid returns.

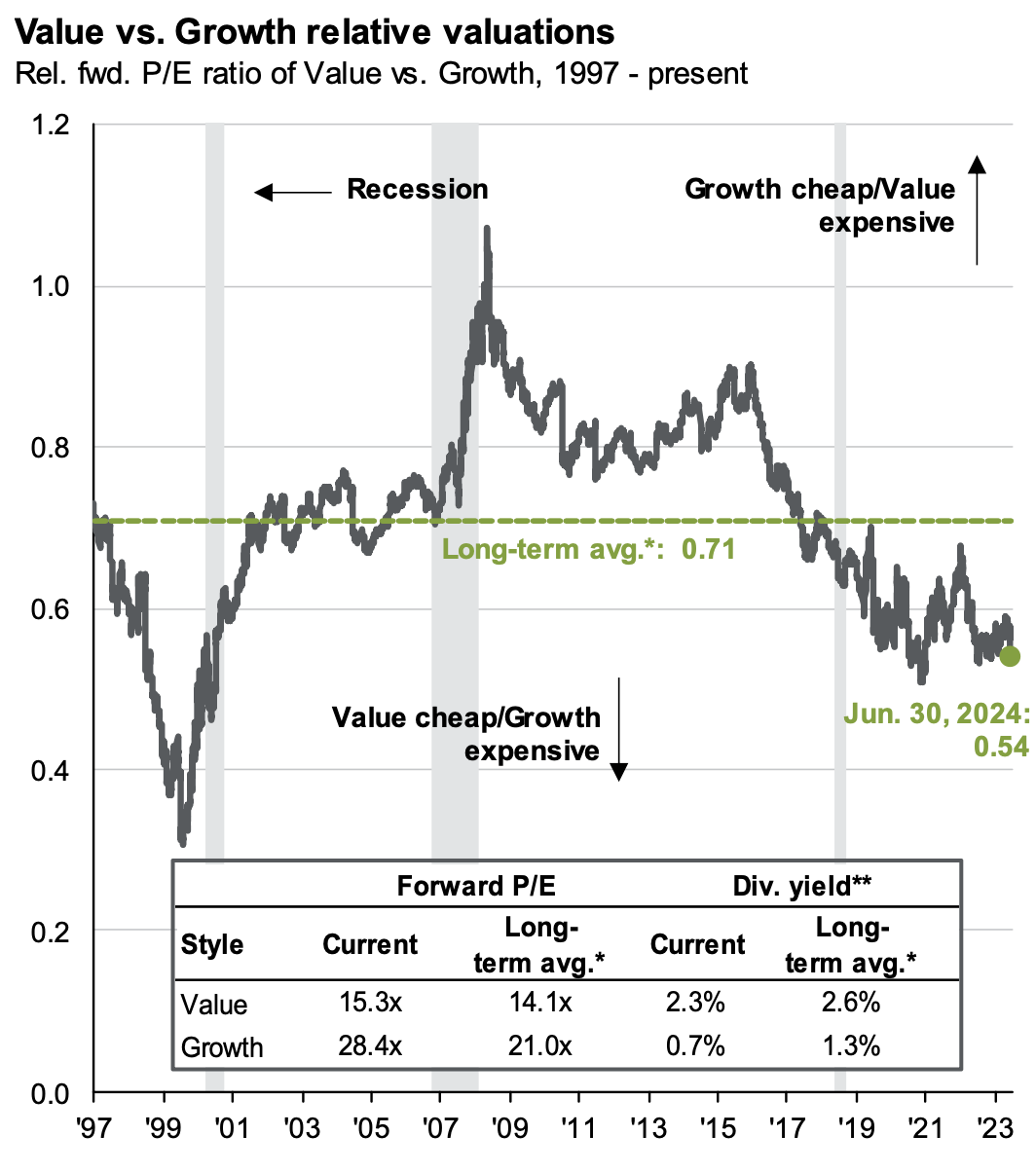

US Equities: growth vs value/quality

It is normal and logical to pay more for a growing stream of cash flows vs one that is static or slower growing. Said another way, valuations for growth companies should be, and almost always are, higher than those for “value” or “quality” companies. These latter terms in quotation marks are somewhat subjective, but they typically refer to more mature, slower growing, and usually more stable companies.

Source: J.P. Morgan Asset Management, with data from FactSet, Russell, NBER; Growth is represented by the Russell 1000 Growth Index, Value by the Russell 1000 Value Index. Long-term averages are monthly, since Dec 1997.

As the chart on the left shows, over the last couple of years the growth valuation premium in the US has been somewhat larger than we seen for several decades. The PE ratio for US value is currently 46% lower than that for US growth, higher than the 29% average discount we have experienced since 1997. The larger discount for value vs growth is mostly the result of higher valuations for US growth (28.4x PE now versus its long-term average of 21x), not lower valuations for US value (15.3x PE now versus its long-term average of 14.1x).

We find the stubbornly persistent large discount for US value to be somewhat surprising in the face of higher interest rates these last couple of years. Growth stocks have more of their cash flow coming through in the distant future and thus the current value of those cash flows (i.e. discounted cash flow) falls as rates rise. Value stocks, which have a greater proportion of their cash flow in the near term, usually suffer less than growth stocks in a rising interest rate environment. Additionally, higher rates tend to hurt growth companies due to their greater need to borrow.

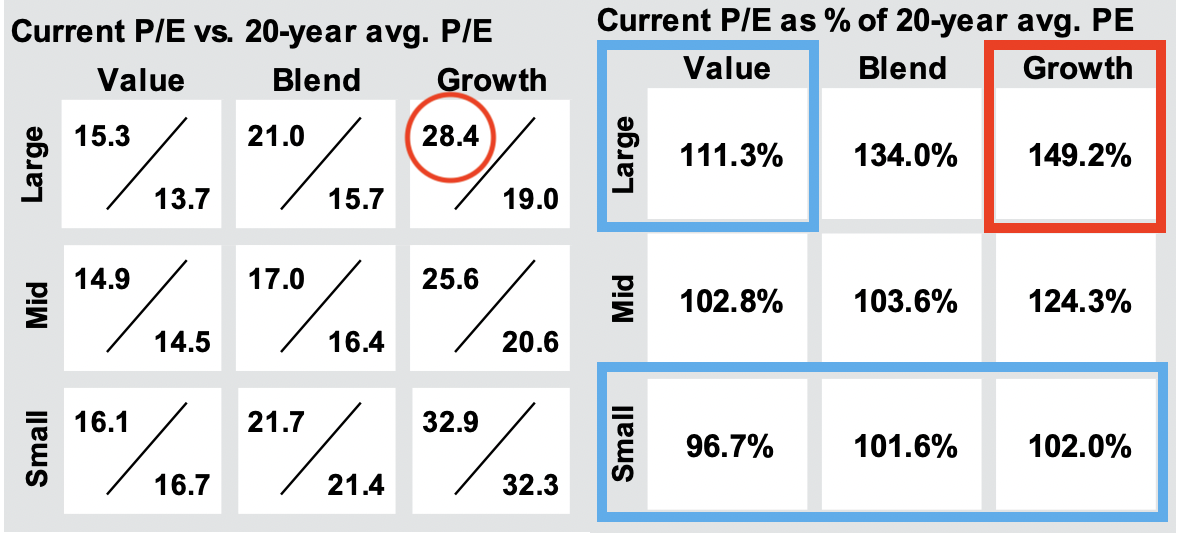

US Equities: large cap vs smaller caps

Just as investors have bid up the valuations of US growth companies well above the long-term averages, so too have they bid up the valuations of the largest US companies (aka large caps). Below are two 3x3 matrices, the first displaying current and 20-year average PE ratios for US companies, with value to growth on the x-axis, and large to small sized companies on the y-axis. The second matrix presents is a derivative of the first matrix, showing the ratio of the current PE to the 20-year average PE. They show that small caps are currently valued near their 20-year averages, while large caps, and especially large cap growth (dominated by big tech) are trading nearly 50% above their long-term average, at a 28.4x PE. The blue boxed areas are where AlphaGlider strategies are concentrating their US equity investment (large value and small caps) and the red boxed area is where they are light in exposure (large growth).

Source: J.P. Morgan Asset Management

We use fundamental analysis tools that have historically proven useful to predict the future returns, but only over long time horizons such as 10-20 years. We would love to have more confidence in predicting shorter-term future returns, but we do not believe they exist.

Our valuation metrics currently show that the best performers over the last decade and a half, such as US equities in general, and US large cap growth equities in particular, have reached valuations at the high end of their historic range. These high valuations foreshadow lackluster returns over the coming 10-15 years.

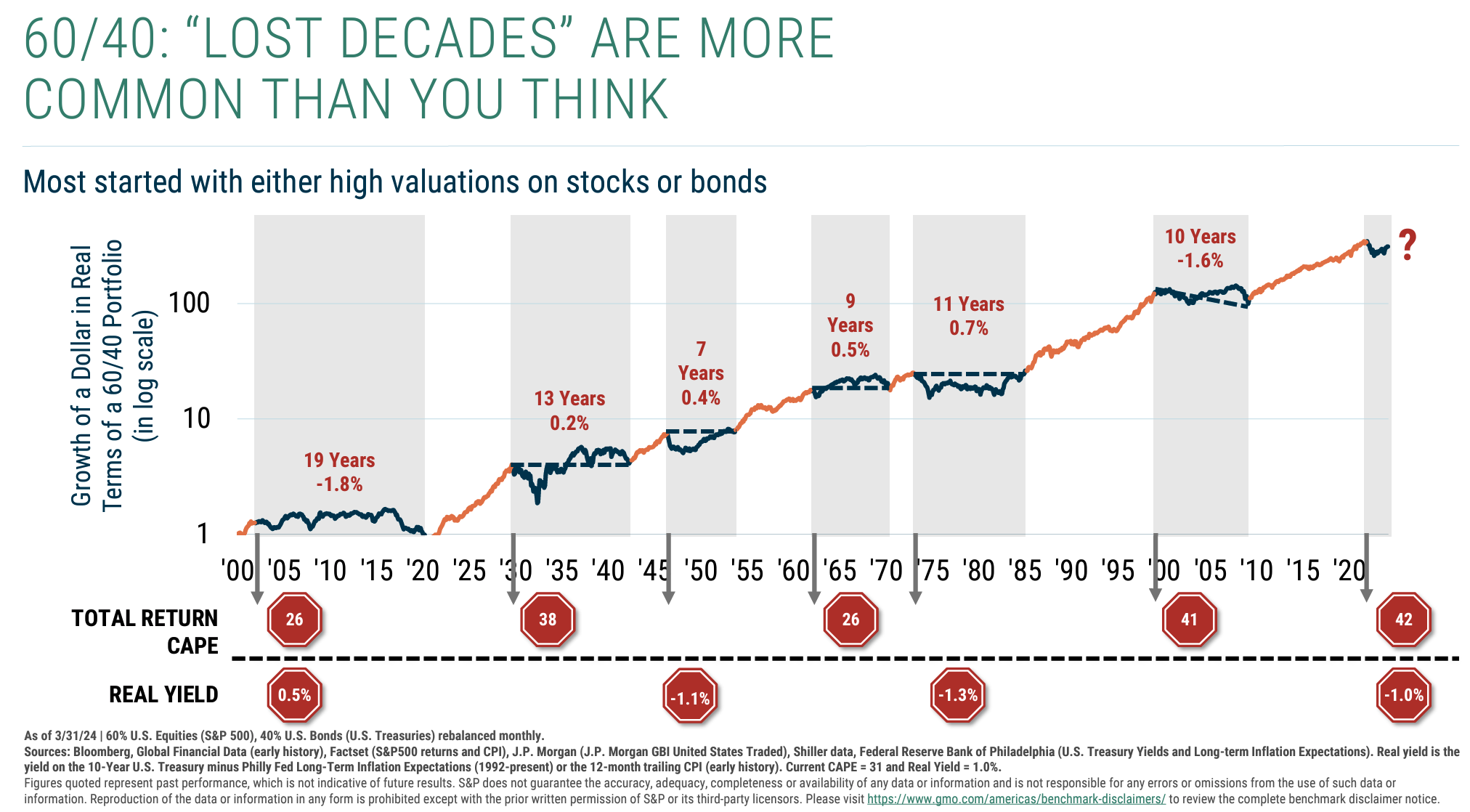

We are not the only ones concerned about US-centric investment portfolios at the moment — the good folks at GMO put together the following log scale chart detailing 120 years of performance of a balanced US portfolio containing 60% S&P 500 equities and 40% US bonds. The couple of take-home points from this chart are that 1) weak periods of performance for this balanced portfolio (i.e. lost decade) are more frequent than you think, and more importantly, 2) that each weak period starts with either high valuations for stocks (as measured by CAPE ratios) or for bonds (using real rates on the 10-year Treasury, that is the yield less inflation expectations), or for both. In early 2020, just before the Covid pandemic began, we had both — 42x CAPE for the S&P 500 and -1% real yield on the 10-year Treasury. Four years on and this balanced 60/40 US portfolio has gone sideways, mainly due to a poor showing by bonds in the face of rising interest rates (the 10-year Treasury now has a reasonably attractive 2.1% real yield).

Source: BMO

The shoe has yet to fall on the S&P 500 though, with its CAPE ratio sitting on a still high 35x. It’s too early to tell if we are in the middle of another lost decade for this balanced 60/40 US portfolio, but our valuation metrics indicate that the 60% equity portion of this portfolio may struggle over the coming decade.

We think AlphaGlider strategies have a greater chance to avoid a lost decade of returns than this balanced 60/40 US portfolio, thanks to our strategies’ underweighting of the most expensive parts of the US equity market, and neutral to overweighting of more reasonably priced equities, such as developed and emerging foreign markets, US value, US quality, and US small cap. Below are expected long-term annual real (before inflation) returns for various equity categories that Research Associates (RA) uses to craft it own funds. They use similar fundamental analysis tools as we do, thus it should come as no surprise that we are in general agreement with them. Note that they expect US large cap to appreciate less than 1% above inflation per year over the next decade, whereas they are looking for high single digit annual growth above inflation for most categories of foreign equities.

Source: AlphaGlider, Research Associates

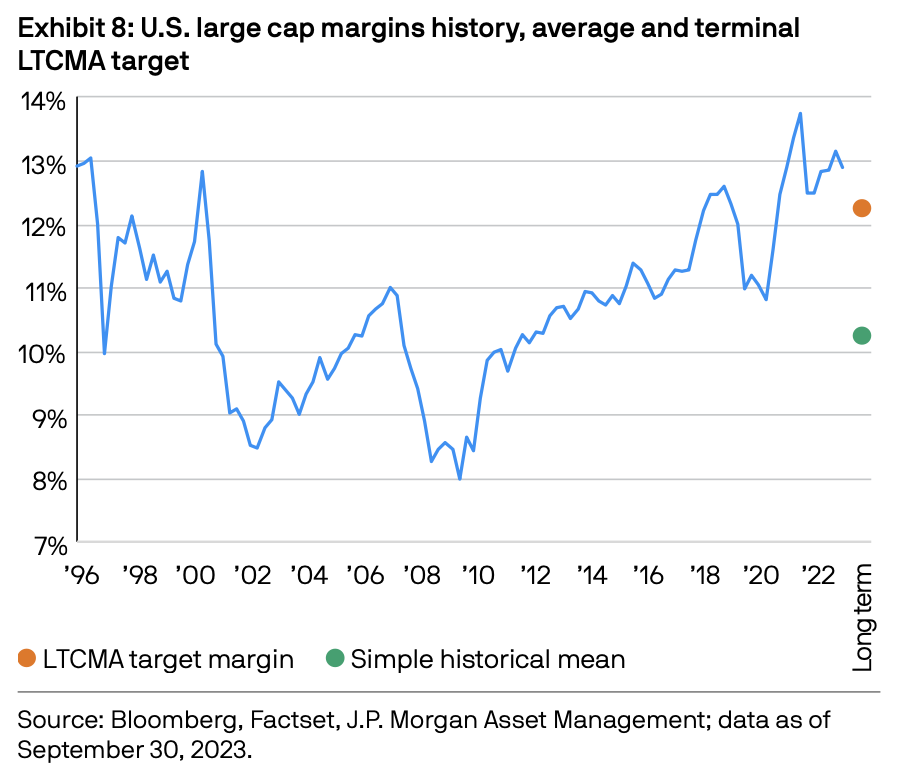

Source: J.P. Morgan Asset Management

Our own financial planning tool, AlphaGlider Planning , uses long-term estimated returns from JP Morgan Asset Management (JPMAM). Unlike RA, JPMAM’s return estimates are on a nominal basis (including inflation), and thus appear higher due to their inclusion of inflation. One major area of difference between the two shops is in their return forecasts for US large caps. As shown in the chart to the right, JPMAM assumes that large US companies will be able to maintain most of the dramatic recent increase in their operating margins into the long-term. Although we do not rule this out, we think it is more likely that reversion to the mean will win out. But even assuming JPMAM’s rosy US large cap margin outlook, they still forecast that other segments of the US equity market and foreign equity markets will match or beat US large cap over the coming 10 to 15 years, as shown in the chart below.

Source: AlphaGlider, JP Morgan Asset Management

While we spend most of our time using fundamental analysis tools to shape our portfolios, we also monitor softer, less concrete signals about valuations and the market psychology behind them. For example, we pay attention to insider buying and selling, investor sentiment, and stock ownership measurements. The chart on the following page is an example of the latter, the value of equities as a percentage of all US households’ total financial assets. This is a contrarian signal, with high levels of stock ownership often indicating investor overconfidence in the stock market, and subsequent poor investment stock returns. Likewise, low stock ownership often indicating under confidence in the stock market, and subsequent strong investment stock returns. High levels usually occur after a strong run in the stock market which naturally drives up the proportional value of stocks within household financial assets (unless one rebalances), but also drives up greed and the fear of missing out (FOMO) among them. On the other hand, low levels of stock ownership occur after a bear market when investors are left reeling and fearful. In simple terms, you want to be underweight stocks when most everyone loves them, and you want to be overweight them when most everyone hates them.

Source: AlphaGlider, NDR

Up until now, there have been three prominent peaks in stock ownership by US households in the post-war era. The oldest was the 29.5% reached at the peak of the Nifty Fifty bubble in the late 1960s. The next one was the 30.9% reached at the peak of the Dotcom bubble in early 2000. The most recent peak was the 26.2% reached during the housing bubble that helped trigger the global financial crisis. The subsequent average annual real returns for the S&P 500 over the 10 years following each of these three previous peaks was -3.5% (thus a -30% real decline over 10 years), -3.5%, and 5.1%. As of the end of the first quarter, equities made up 34.7% of US households’ total financial assets, an all-time post-war record. As contrarian investors, we see this as a signal to minimize our US equity exposure.

Also of note from this chart is how the S&P 500 performed in the 10 years following troughs in equity ownership among US households. After the Nifty Fifty bubble finally deflated by the early 1980s, stocks only made up 8.4% of US households’ financial holdings, less than a quarter of today’s level. Those stocks went on to deliver 13.7% annual real returns for the next decade (a near quadrupling over the period!). At the market trough of the global financial crisis in early 2009, stocks made up 14.7% of US households’ financial holdings, less than half of today’s level. Those stocks went on to deliver 11.3% annual real returns for the next decade (a near tripling!).

It is at market extremes that fortunes are made and lost in the stock market. I would venture to say that there is a much higher chance that fortunes will be lost over the next decade than will be made in the S&P 500. Perhaps this time is different and that generative AI will be the driver of accelerating profits and cash flow for US large cap, but we do not think the risks are worth taking for the reward. We resist being pulled into the FOMO being generated at the moment. We are more than happy to accept a slightly lower return while this frenzy continues, knowing that we are protecting our downside risks in this historically highly valued and over-bought market.

**NOTES & DISCLOSURES**

1This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

2Mutual funds, exchange-traded funds and exchange-traded notes are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

3Alternative investments, including hedge funds, commodities and managed futures involve a high degree of risk, often engage in leveraging and other speculative investments practices that may increase risk of investment loss, can be highly illiquid, are not required to provide periodic pricing or valuation information to investors, may involve complex tax structures and delays in distributing important tax information, are subject to the same regulatory requirements as mutual funds, often charge higher fees which may offset any trading profits, and in many cases the underlying investments are not transparent and are known only to the investment manager. The performance of alternative investments including hedge funds and managed futures can be volatile. Often, hedge funds or managed futures account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, including hedge funds and managed futures and none is expected to develop. There may be restrictions on transferring interests in any alternative investment. Alternative investment products including hedge funds and managed futures often execute a substantial portion of their trades on non-US exchanges. Investing in foreign markets may entail risks that differ from those associated with investments in the US markets. Additionally, alternative investments including hedge funds and managed futures often entail commodity trading which can involve substantial risk of loss.

4Rebalancing can entail transaction costs and tax consequences that should be considered when determining a rebalancing strategy.

^Indices are unmanaged and investors cannot invest directly in an index. The performance of indices do not account for any fees, commissions or other expenses that would be incurred.

aThe Standard & Poor's 500 (S&P 500) Index is a free float-adjusted market capitalization weighted index that is designed to measure large cap US equities. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization in the US equity markets.

bMSCI Europe, Australasia and Far East (EAFE) Index is a free float-adjusted market capitalization weighted index that is designed to measure the investable universe of developed market equities outside of the US.

cMSCI Emerging Markets (EM) Index is a free float-adjusted market capitalization weighted index that is designed to measure large and mid-cap equity market performance in the global Emerging Markets.

dMSCI All-Country World (ACWI) Investable Market Index (IMI) is a free float-adjusted market capitalization weighted index that is designed to measure the investable universe of global equity markets.

eThe Bloomberg Barclays US Aggregate Bond Index is a market capitalization weighted index that is designed to track most investment grade bonds traded in the United States. The index includes Treasury securities, government agency bonds, mortgage-backed bonds, corporate bonds and a small amount of foreign bonds traded in the United States. Municipal bonds and Treasury Inflation-Protected Securities (TIPS) are excluded due to tax treatment issues.

Copyright © 2024 AlphaGlider LLC. All Rights Reserved.

No part of this report may be reproduced in any manner without the express written permission of AlphaGlider LLC.